Reserves are another common feature of standard factoring contracts. Holding Reserve Funds On Factored Invoices Watch for these terms in factoring contracts. In short, a non-recourse factoring agreement may sign away some control of your company for years at a time. These companies may decide a broker’s credit isn’t good enough to factor their invoices-even if it’s someone you’ve been working with for years. For instance, unless the broker or shipper files the right paperwork, the collections insurance may not protect the trucker.Įven worse, non-recourse contracts often give factoring companies control over who you work with. There’s a clear trade-off there-but in practice, as we’ve written, the higher costs of non-recourse factoring agreements outweigh the benefits. Recourse agreements don’t include this insurance. Non-recourse agreements include collections insurance essentially, they make it so factoring companies can’t seek payment from their own clients when a debtor declares bankruptcy. What happens when a broker or shipper hires you to haul a load, then goes out of business before they pay? The factoring company may come back to the trucker for those unpaid funds. Non-Recourse Factoring Contractsįactoring contracts may describe two broad types of agreements-“recourse” and “non-recourse”-to handle a potentially costly event. If you do choose to review some factoring contracts, however, keep the following points in mind. You can leave with 30 days’ notice at any time-with no termination fees of any kind. Factor as many or as few invoices as you prefer, all with a single, uncomplicated factoring fee. No-contract factoring with Bobtail keeps you in the driver’s seat of your own business. The contract may even give them say over who you work with. Companies often build volume requirements into a factoring agreement, meaning they may require you to factor most or all of your invoices through them. If you want to leave early, you could be hit with a termination fee. Contracts require you to deal exclusively with one factoring company for a term that could be as long as three years. To understand why, just consider the common terms and conditions of factoring contracts. If you value freedom in the way you run your business, no-contract factoring is the way to go.

Bobtail is a no-contract factoring tool that gets you funding without locking you into long deals or complicated requirements. The truth is, you don’t need a contract to factor. Your most important choice about a factoring contract is whether to sign one in the first place. Rather skip the contract altogether? Learn more about Bobtail’s no-contract factoring tool here. Keep reading to learn what to watch for, and keep this guide handy as you compare providers and review factoring contracts.

#Invoice factoring agreement full

In fact, most factoring companies force trucking companies into restrictive factoring contracts-and those contracts can be full of confusing language. It all depends on the partner you choose. But factoring can range from easy and straightforward to complex and full of surprises.

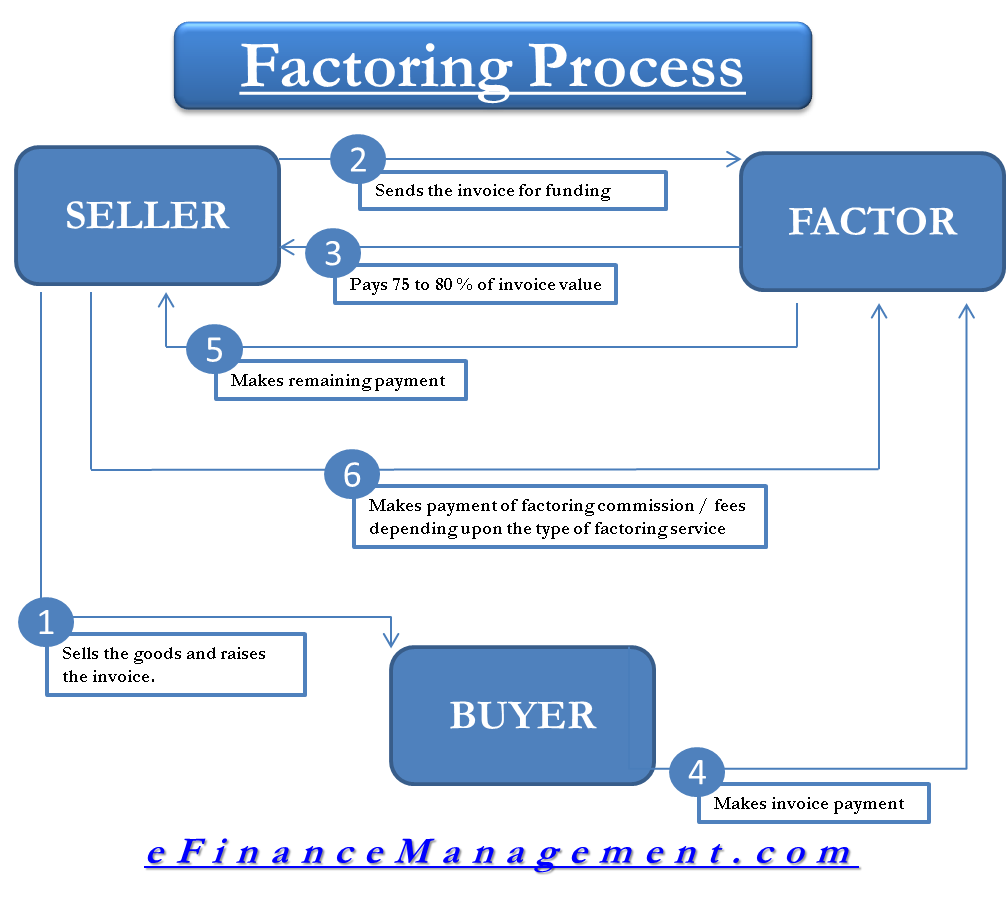

The factoring company then collects payment from your debtors, the brokers and shippers who hire you. The concept of factoring is simple enough: It’s a financial tool in which a third-party company buys your open invoices for their full amount, minus a small percentage fee.

Thinking of factoring your trucking invoices? It’s a great way to ensure consistent cash flow, even when shippers and brokers take weeks to pay.

0 kommentar(er)

0 kommentar(er)